Disrupting B2B payments & driving purchasing efficiencies for SMBs

Sadiq Damani6 min read

SMBs are in need of innovative and connected tools that solve these complex problems. Theodo and Codat partnered to produce a proof of concept application that showcases how fintechs and incumbent banks can help small businesses drive payment efficiencies by leveraging consented data.

What is wrong with B2B payments today?

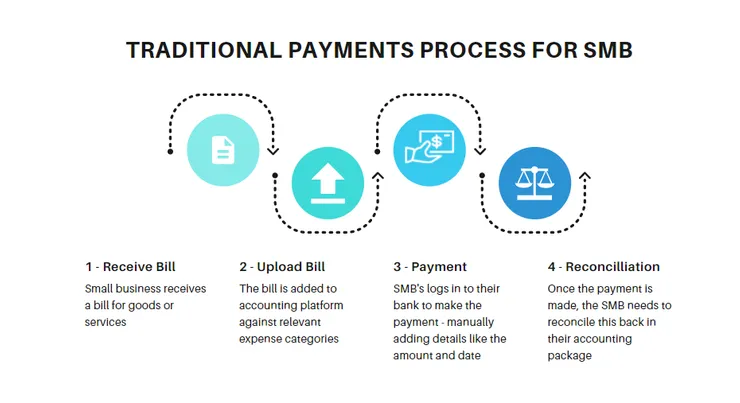

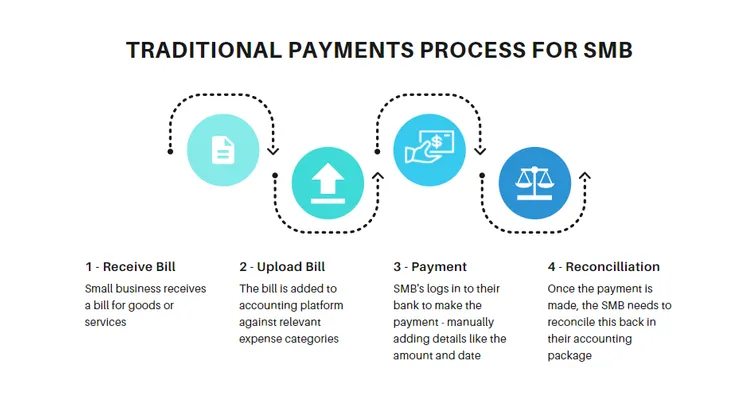

The traditional ways in which businesses pay bills is over complicated and manual, leaving room for error which increases the cost and burden on SMBs.

To help with growth, finance teams are increasingly expected to perform more strategic roles, yet many of the functions and processes they’re required to manage are archaic and in need of optimisation. Owing to these inefficient practices, the accounts payable team is often left struggling with mounting paperwork, the threat of late payments, data errors, and with no means of providing accurate management reporting. The following statistics outline the extent of this problem:

- Poor payment processes cost up to $10 per invoices for SMBs.

- 60% of businesses admit to late payment fees causing reputational damage and supplier friction.

- 32% of businesses report duplicate payments for the same invoice.

- 56% of businesses admit planning is a challenge because they do not have visibility of upcoming bills to pay.

What can you do to help small businesses?

SMBs are in need of innovative and connected tools that solve these complex problems. Theodo and Codat partnered to produce a proof of concept application that showcases how fintechs and incumbent banks can help small businesses drive payment efficiencies by leveraging consented data. The key objectives of this project were to produce a tool that would deliver the following benefits for SMBs:

Visibility

- Allow businesses to see all of their outstanding bills, their value, and due date in one place to enable them to accurately forecast and schedule upcoming spend.

Security

- Reduce invoice fraud and streamline payments validation by using open banking data and other tools to verify a supplier’s bank details before executing large payments.

Automation

- Minimise friction between different business systems and make it easier to see what is outstanding and then make the payments in a single interface.

Accuracy

- Drive better accuracy with payment amounts and the status of the bill.

Speed

- Enable SMBs to focus on their growth by saving them hours of manual reconciliation

What did we build?

Key Features:

Authorisation

Rather than build directly to the accounting platforms, we chose to integrate with Codat. This meant we could rely on a single data model and did not have to write libraries and handlers for complexities such as token refresh and request throttling.

We were able to save considerable engineering time by taking advantage of Codat’s Link product, an out-of-the-box and no-code solution that handles the authorisation process.

Retrieve list of bills

Once the connection is authorised by the user, Codat’s REST API makes it easy to retrieve a list of accounts payable invoices (bills) in a standardised format, meaning once we had built the integration for QuickBooks, it worked seamlessly for other platforms without requiring changes. For each bill we included information such as line item detail and expense category and even a jpg or pdf attachment of the invoice.

Mapping

It’s absolutely critical that the payment is recorded against the correct account in the business’s accounting system - Codat makes this easy by providing a list of accounts available in our API to query.

Reconcile payments

The final step of the puzzle involves reconciling the payment back to the business’s accounting platform. Codat’s API is bi-directional, which enables you to create a payment and reconcile this against outstanding bills. This ensures their accounting platform is always up to date and saves time with manual entry.

How did we achieve this?

Implementing agile practice, the Theodo team started with a proof of concept console application, to ensure the API calls were successful. The Codat Swagger made this process seamless, as it provided the developers with real-time visibility and a simple way of adopting these with Axios.

The team moved on to building a dynamic frontend experience for users using google MUI react components and next.js, with particular focus on transaction consistency, to ensure all data is displayed correctly and latency does not cause any issues.

“The tight feedback loop with the Codat team, combined with a focus on ease of operation, resulted in an ever-improving interface; for example, the team incorporated pagination and loading components to maintain user engagement. The API sandbox set-up meant the team could access the platform and create mock companies, integrating the user experience at every stage of the development process.”

The cost of building an API integration can easily run into the thousands, depending on the number and complexity of the integrations. Codat’s API has a number of advantages that drastically reduce the integration complexity, therefore increasing the speed to market. The first is that only a single integration is needed, a key factor in reducing complexity. Secondly, the API is simple, meaning less work is needed for the system to communicate. The data relationships between systems are also standardised, ensuring clean data transfer. Finally, the precise documentation means that if any changes do need to be made, they can be actioned quickly and efficiently.

The quality of the API offers clients a Portal with deep integrations to a vast number of external platforms, such as Xero and QuickBooks Online (QBO), as well as Desktop (QBD) and complex ERPs (including NetSuite and Intacct). These integrations allow for near real-time data syncs between systems, delivering instantaneous business value for a client.

How can Codat & Theodo help you build better SMB products?

Codat is the universal API for small business data. Codat provides two-way connectivity to over 30 different accounting, banking, and commerce systems used by small businesses, including Xero, Plaid, QuickBooks, Stripe, Oracle NetSuite, Shopify and Sage Intacct. Codat’s integrations are standardised to a single data model, allowing clients to build to Codat once rather than having to sink their own engineering resources into building and maintaining each complex integration themselves.

Theodo partners with businesses of all sizes, helping to increase their market share by building bespoke digital products that users love. Lead-time is critical when reacting to market opportunity, thus pragmatic technical solutions are essential.

Click here to learn more about how to build a B2B payments solution.

SadiqD | Partner @ Theodo

“The market is flooded with solutions that seem to solve every problem in the world. In reality, only a few do what they say on the tin. The more we’ve delivered solutions that centre around Codat, the more opportunities I see with it. For any business looking to help companies make the most from their financial data, Codat is truly a no-brainer. Our engineering team loves it, and the Codat team is so easy to partner with”.